- تحليلات

- مزاج السوق

Dollar bearish bets slipped after Biden’s inauguration

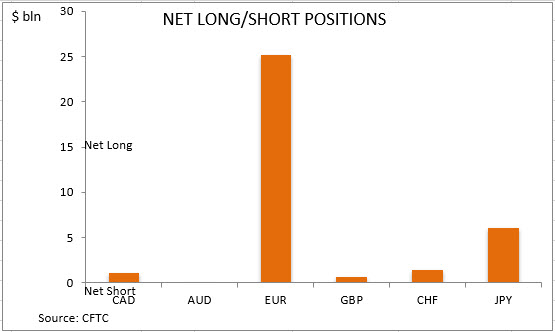

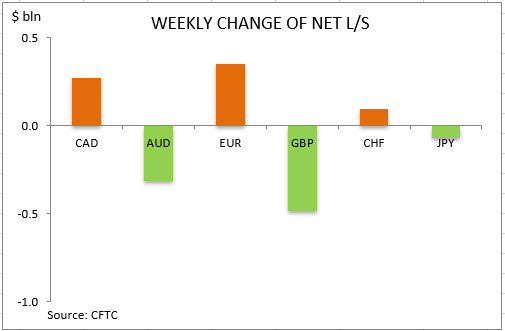

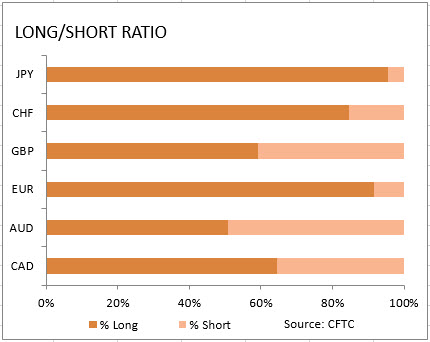

US dollar short bets increase paused with net short bets inching down to $34.40 billion from $34.48 billion against the major currencies during the one week period, according to the report of the Commodity Futures Trading Commission (CFTC) covering data up to January 26 and released on January 29. The dollar sentiment was essentially unchanged with increase in bullish bets on euro and Canadian dollar overshadowed by decreases in Pound and Australian dollar bullish bets as the European Central Bank kept interest rates unchanged but said it stands ready to act. The increase in dollar bearish bets paused following Joe Biden’s inauguration and Markit report US Manufacturing PMI rose to 59.1 month for January from 57.1 the previous month, with services sector also accelerating its expansion. Readings above 50.0 indicate industry expansion, below indicate contraction. However, US Labor Department reported 900 thousand Americans sought unemployment benefits over the last week, down from 926 thousand the previous week.

CFTC Sentiment vs Exchange Rate

| January 26 2021 | Bias | Ex RateTrend | Position $ mln | Weekly Change |

| CAD | bullish | negative | 1085 | 274 |

| AUD | bullish | negative | 60 | -314 |

| EUR | bullish | negative | 25135 | 354 |

| GBP | bullish | negative | 684 | -484 |

| CHF | bullish | negative | 1422 | 97 |

| JPY | bullish | negative | 6016 | -69 |

| Total | 34402 |

أداة حصرية جديدة للتحليل

ا يوجد نطاق زمني محدد – من يوم إلى سنة

أي مجموعة تداول – فوركس ، أسهم ، مؤشرات إلى أخره..

:تنبيه

يحمل هذا الموجز طابعاً إعلامياً و تعليمياً و تنشر بالمجان . تأتي معظم البيانات المدرجة في الموجز من المصادر العامة معترفة أكثر و أقل موثوقية . مع ذلك ، لا يوجد تأكيد على أن المعلومات المشارة إليها كاملة و دقيقة . لا يتم تحديث الموجز . معظم المعلومات في كل موجز ، تتضمن الرأي و المؤشرات و الرسوم البيانية و أي شيئ اخر وتقدم فقط لأغراض التعريف وليس المشورة المالية أو توصية . لا يمكن اعتبار النص باكماله أو أي جزء منه و أيضاً الرسوم البيانية كعرض لقيام بصفقة بأي اداة . آي إف سي ماركيتس وموظفيها ليست مسؤولة تحت أي ظرف من الظروف عن أي إجراء يتم اتخاذه من قبل شخص آخر أثناء أو بعد قراءة نظرة عامة .

التقارير السابقة

- 18مارس2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10مارس2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4مارس2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...