- Analytics

- Trading News

- China Rate Cut Surprise

China Rate Cut Surprise

China's central bank, PBOC, surprised financial markets by cutting key interest rates on Monday in an effort to boost the country's slowing economy.

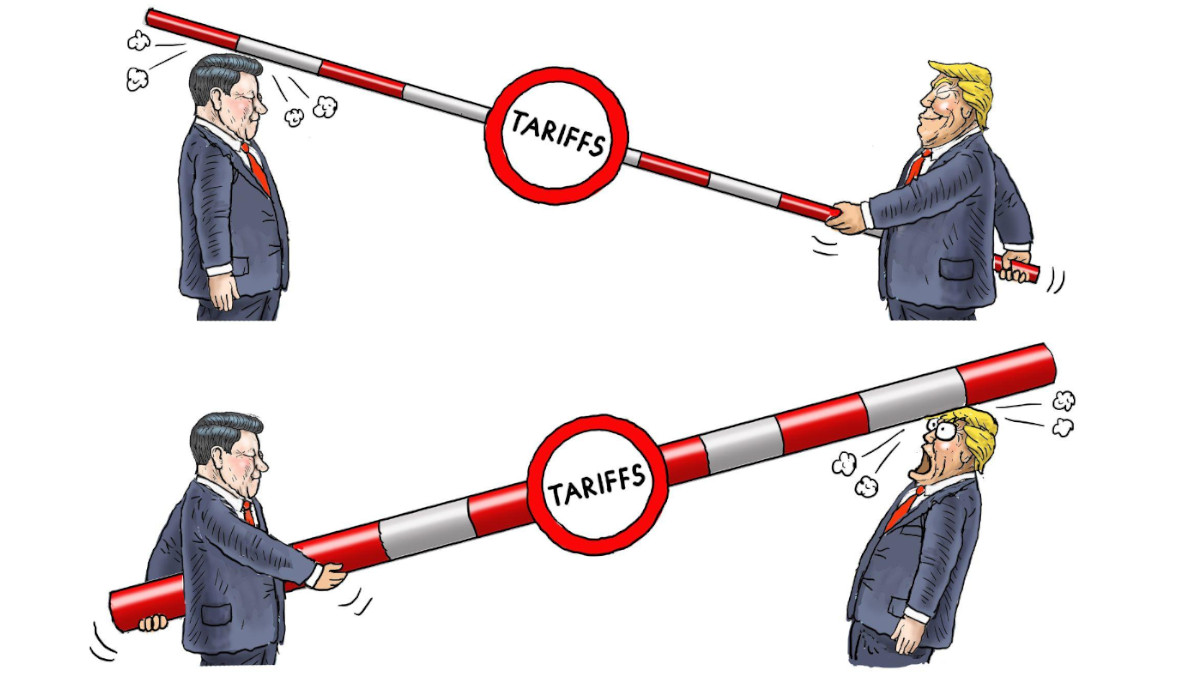

This move comes after China reported weaker-than-expected economic data for the second quarter and a key political meeting that emphasized achieving this year's growth target. The country faces multiple challenges including deflation, a property crisis, high debt levels, and weak consumer and business confidence.

Also, trade tensions are rising as other countries become increasingly concerned about China's dominance in exports.

The PBOC cut the seven-day reverse repo rate, a key short-term policy rate, from 1.8% to 1.7%. It also reduced benchmark lending rates by the same amount. The one-year loan prime rate (LPR) fell from 3.45% to 3.35%, and the five-year LPR went down from 3.95% to 3.85%.

Factors Contributed to Rate Cuts

- The significant slowdown in economic growth during the second quarter and the pressure to meet the annual growth target were likely key considerations.

- The expectation that the US Federal Reserve will soon begin cutting interest rates may have given the PBOC room to ease its own policies, especially considering the pressure on the Chinese yuan due to the difference in interest rates between the two countries.

The PBOC also announced adjustments to its lending program, aimed at making it easier for banks to provide loans. This is expected to help lower long-term interest rates and address the issue of a potential bond bubble.

The reaction of financial markets to this news was mixed. The Chinese yuan weakened slightly before recovering some losses. Chinese bond yields fell across the board, and bond futures prices rose. Analysts expect further rate cuts in China in the coming months, following any potential cuts by the US Federal Reserve.

USDCNH Technical Analysis

The USD/CNH currency pair has been steadily climbing over the past two weeks, finding support around the 50-day moving average. This upward trend has pushed the pair against resistance at 7.2949, a level that has limited gains since early July. If this resistance breaks, the USD/CNH could potentially retest the 2024 highs at 7.3110.

A breakout above resistance at 7.2949 could signal further gains for the USD/CNH, but the PBoC's easing stance and potential mispricing of Fed rate cuts could lead to a reversal of fortunes for the currency pair.

The key question for the USD/CNH is whether market expectations for aggressive Fed rate cuts are overblown. If the Fed delivers smaller rate cuts than anticipated, the dollar could regain strength against the yuan and other Asian currencies.