- Analytics

- Technical Analysis

WHEAT Technical Analysis - WHEAT Trading: 2017-10-13

High global stock estimate bearish for wheat prices

Global wheat inventory is expected to rise in 2017-18. Will the wheat price continue falling?

The US Department of Agriculture WASDE monthly report upgraded world wheat inventory estimate for 2017-18 by 4.99 million tons to 268.13m tons. The increase was due to higher estimates for major wheat producers including US, Russia and European Union despite a downgrade for Australia inventory. The increase in US inventory resulted from reduced expectations of use of grain in livestock feed. Higher global stocks are bearish for wheat prices.

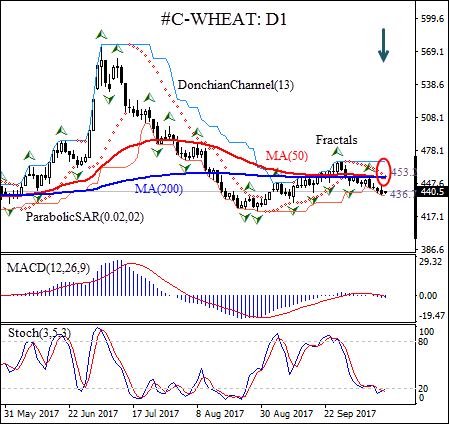

On the daily timeframe WHEAT : D1 is trading with negative bias after retracing higher following the decline from fourteen-month high in mid-January. The 50-day and 200-day moving averages MA(50) and MA(200) have formed a Dead Cross chart pattern, highlighted by the red oval.

- The Donchian channel gives a neutral signal: it is flat.

- The Parabolic indicator has formed a sell signal.

- The MACD indicator gives a bearish signal: it is below the signal line and the gap is widening.

- The stochastic oscillator is rising from the oversold zone.

We expect the bearish momentum will continue after the price closes below the lower Donchian bound at 436.7. It can be used as an entry point for a pending order to sell. The stop loss can be placed above the last fractal high at 453.2. After placing the pending order the stop loss is to be moved following Parabolic signals. Thus, we are changing the profit/loss ratio to the breakeven point. If the price meets the stop loss level (453.2) without reaching the order (436.7), we recommend cancelling the position: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Sell |

| Sell stop | Below 436.7 |

| Stop loss | Above 453.2 |

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.