- Education

- Infographics

- Brent vs WTI

Brent vs WTI - Oil Infographic

Share this infographic

Copy & paste the code below to embed the full infographic on your website.

Brent vs WTI

Brent and WTI futures contracts are two crude oil futures contracts that are among top 10 liquid futures contracts - most traded by volume across different futures exchanges. Brent and WTI are benchmarks, also known as grades, of physical oil.

What is Brent Crude Oil

Brent North Sea Crude, commonly known as Brent crude, refers to oil that is produced in the Brent oil fields and other sites in the North Sea. Brent futures trade on the Intercontinental Exchange (ICE).

Brent price affects the value of roughly two-thirds of the world's crude oil production as it is used as the benchmark for African, European, and Middle Eastern crude oil. The delivery locations for Brent futures vary by country since Brent crude is traded internationally.

What is WTI Oil

West Texas Intermediate, commonly known as WTI, is a US blend of several types of domestic crude oil. WTI futures trade on the NYMEX (New York Mercantile Exchange) division of the CME (Chicago Mercantile Exchange).

WTI benchmark is used by several Asian countries together with Brent to value their crude oil. The delivery location for WTI is in Cushing, Oklahoma. Cushing facility has 90 million barrels of storage capacity.

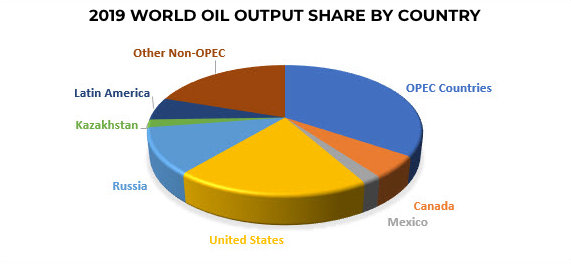

Crude Oil Production by Country 2019

Difference Between Brent and WTI

Difference between Brent and WTI benchmarks, including physical and logistical attributes, result in price differential known as Brent vs WTI spread. While both are "sweet crudes" that have less than 1% sulfur, and are “lighter” - less dense than many of the crude oils extracted elsewhere, their qualitative differences explain the spread part called a quality spread.

Transportation and logistical costs of Brent and WTI (Brent is produced in Europe and WTI in North America) contribute to Brent vs WTI spread referred to as a location spread.

Brent vs WTI spread day-to-day variation is affected by three main factors:

- Crude oil supply and demand balance in the US

- International tensions capable of disrupting crude oil supply

- North Sea crude oil production levels

Brent and WTI Price chart, 2010-2020

Spread Between Brent and WTI

Brent vs WTI spread usually varies around some average value, the price of Brent usually exceeding WTI. Trading Brent vs WTI spread in a simple strategy then involves betting on reversion back to the average value.

The average value can be calculated each day as a simple moving average (SMA) for a certain prior period, say 20-day period. Then if the current spread value is above the SMA(20), a short position in the spread is entered - betting that the spread will decrease to the SMA(20). And the position is closed out when the spread crosses below the SMA(20).

In the case if the current spread value is below the SMA(20) a long position in the spread is entered - betting that the spread will increase to the SMA(20). And the position is closed out when the spread crosses above the SMA(20).

And in case when the current spread is not different from the average value but it is possible to predict a change in the Brent vs WTI spread based on supply/demand or geopolitical circumstances – a simple strategy involves opening a position in the direction of expected movement of the spread.

For example, a long position is entered when lower Bent output levels are expected – betting effectively that the spread will increase. Contrary, when higher Bent output levels are expected a short position is entered - betting effectively that the spread will decrease. Similarly, when lower WTI output levels are expected a short position is entered - betting effectively that the spread will decrease. And when higher WTI output levels are expected a long position is entered - betting effectively that the spread will increase.

To trade Brent vs WTI spread do the following:

- Choose a Broker

- Register for an account

- Choose a trading platform

- Study the spread chart

- Study Brent and WTI supply/demand balance, see if spread price prediction can be made

- Place an order based on your prediction