- Education

- Trading CFDs

- CFD Trading Strategies and Techniques

CFD Trading Strategies and Techniques

Have you ever wanted to trade in the financial markets but don't have the capital to purchase stocks or commodities outright? Or maybe you want to take advantage of both rising and falling markets to maximize your profits? If so, CFD trading might be the perfect fit for you!

CFD trading is a popular financial instrument that allows traders to speculate on price movements in various markets without actually owning the underlying assets. This means you can trade on margin and control a larger position with a smaller amount of capital, opening up new opportunities to profit from financial markets.

But like any form of trading, CFD trading involves risk, and success depends on your knowledge and strategy. That's why we're here to guide you through the most effective trading strategies and techniques for CFDs. Whether you're a beginner or an experienced trader, we will provide valuable insights and tips to help you improve your CFD trading skills and potentially increase your profits. So buckle up, and let's dive into the world of CFD trading strategies!

KEY TAKEAWAYS

- CFDs allow traders to speculate on the price movements of various underlying assets such as stocks, indices, commodities, and currencies without owning the underlying asset itself.

- Trend following is a popular trading strategy used by many traders in various financial markets, including CFD trading.

- Moving Average Crossover: This strategy involves using two or more moving averages of different periods.

- CFD trading can be an exciting and potentially profitable activity. However, it's important to understand the risks involved and take steps to manage them.

Why CFDs are Popular Among Traders

CFDs allow traders to speculate on the price movements of various underlying assets such as stocks, indices, commodities, and currencies without owning the underlying asset itself.

CFDs enable traders to take both long and short positions, meaning they can profit from both rising and falling markets. Traders can also use leverage, which means they can control a larger position in the market with a smaller amount of capital.

CFDs are popular among traders for several reasons, the best part

Flexibility

CFDs offer traders the flexibility to trade a wide range of assets from one trading account, making it easy for them to diversify their portfolios.

Low Costs

Compared to traditional stock trading, CFD trading is relatively low cost, as traders only pay the spread, which is the difference between the buying and selling price of an asset.

Leverage

CFDs allow traders to leverage their positions, meaning they can control a larger position in the market with a smaller amount of capital. This can magnify profits, but also magnify losses.

Short Selling

CFDs allow traders to sell assets they do not own (short selling), making it easier to profit from falling markets.

No Ownership

CFDs allow traders to speculate on the price movements of an asset without owning it, which means they can avoid some of the costs and complexities associated with owning the underlying asset itself.

Importance of having a well-defined trading strategy for successful CFD trading.

Here are a few examples of why having a well-defined trading strategy is important for successful CFD trading:

Minimizes Risk

Let's say you have a well-defined trading strategy that includes a stop-loss level at 2% of your account balance. This means that if the trade goes against you, you will only lose a maximum of 2% of your account balance. Without a trading strategy, you may be tempted to hold onto a losing trade, hoping that it will turn around, which could lead to significant losses.

Increases Consistency

With a well-defined trading strategy, you have a clear plan of action that you can follow consistently. This helps to avoid making impulsive decisions based on emotions, such as entering a trade because you feel like it's a good opportunity, even though it doesn't align with your trading plan.

Helps with Decision-Making

Let's say you have a trading strategy that includes technical analysis and fundamental analysis to identify potential trading opportunities. This helps you to make informed decisions based on market conditions, rather than relying on guesswork or gut feelings.

Enhances Efficiency

With a well-defined trading strategy, you have a clear plan of action that you can follow efficiently. This helps you to avoid wasting time on less critical elements, such as over-analyzing market data or switching between trading methods frequently.

Enables Evaluation

With a well-defined trading strategy, you can evaluate its effectiveness over time.

For example, you can track your trading results and adjust your strategy as needed to improve your performance. Without a trading strategy, it may be difficult to determine what is working well and what needs to be improved.

Trend Following Strategies

Trend following is a popular trading strategy used by many traders in various financial markets, including CFD trading. The basic idea behind trend following strategies is to identify the direction of the market trend and enter trades in the same direction, with the aim of profiting from the momentum of the trend.

Here are some examples of trend following strategies:

Moving Average Crossover

This strategy involves using two or more moving averages of different periods. When the shorter-term moving average crosses above the longer-term moving average, it signals a potential uptrend, and a long position can be taken. Conversely, when the shorter-term moving average crosses below the longer-term moving average, it signals a potential downtrend, and a short position can be taken.

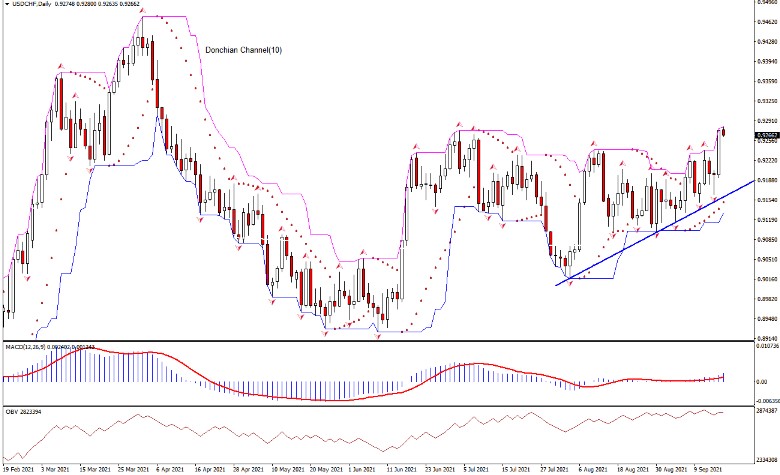

Donchian Channel Breakout

This strategy involves using the highest high and lowest low of a certain number of periods to create a channel. When the price breaks above the upper channel, it signals a potential uptrend, and a long position can be taken. When the price breaks below the lower channel, it signals a potential downtrend, and a short position can be taken.

Parabolic SAR

This strategy involves using the Parabolic SAR indicator (Stop and Reverse), which places dots above or below the price to indicate potential trend reversals. When the dots are below the price, it signals a potential uptrend, and a long position can be taken. When the dots are above the price, it signals a potential downtrend, and a short position can be taken.

Moving Average Ribbon

This strategy involves using multiple moving averages of different periods plotted on the same chart. When the moving averages are stacked in a specific order, such as from shortest to longest, it signals a potential trend direction. When the moving averages are pointing upwards, it signals a potential uptrend, and a long position can be taken. When the moving averages are pointing downwards, it signals a potential downtrend, and a short position can be taken.

Mean Reversion Strategies

Mean reversion strategies are based on the idea that over time, prices tend to revert to their mean or average value. This means that if an asset's price has deviated significantly from its average value, there is a higher likelihood that it will eventually move back towards the mean. Here are some key points to keep in mind when using mean reversion strategies:

- Identify overbought or oversold conditions: Mean reversion strategies often rely on identifying overbought or oversold conditions using technical indicators such as the Relative Strength Index (RSI) or the Stochastic Oscillator. For example, when an asset is considered overbought, it means that its price has increased too much too quickly and is likely to pull back in the near future.

- Wait for confirmation: It is important to wait for confirmation before entering a trade based on a mean reversion strategy. This can involve waiting for the price to start moving back towards the mean or for a technical indicator to generate a signal. For example, in the chart below, the RSI indicator is used to identify an overbought condition, and a sell signal is generated when the RSI crosses below the overbought level.

- Set stop-losses: Stop-losses are important when using mean reversion strategies, as prices can continue to move away from the mean for longer than expected. A stop-loss can be set above the recent swing high in a short position or below the recent swing low in a long position. For example, in the chart below, a stop-loss is set above the recent swing high to limit potential losses if the price were to continue to move higher.

- Take profits quickly: Mean reversion strategies often involve taking profits quickly as prices may only move back towards the mean for a short period of time. This can involve setting a profit target or using a trailing stop-loss to lock in profits. For example, in the chart below, a profit target is set at the 20-day moving average, which is the mean value used in this mean reversion strategy.

Breakout Strategies

Breakout strategies are used by traders to identify and take advantage of price movements that break through support or resistance levels, indicating a potential trend reversal or continuation. Here are some key points about breakout strategies:

- Identifying support and resistance levels: Traders using breakout strategies need to identify key support and resistance levels on the price chart. These levels can be identified using various technical indicators such as moving averages, trendlines, and chart patterns.

- Entry and exit points: Once the support and resistance levels are identified, traders can set entry and exit points for their trades. For example, they might enter a long position when the price breaks above a resistance level, and exit the trade when the price reaches the next resistance level.

- Stop-loss orders: Breakout traders typically use stop-loss orders to limit their losses in case the trade goes against them. They might set the stop-loss order just below the support level for a long position or just above the resistance level for a short position.

- Volatility considerations: Breakout strategies work best in markets with high volatility, as this increases the likelihood of price movements breaking through support or resistance levels. Traders need to be aware of the market volatility and adjust their strategy accordingly.

Examples:

Trading the breakout of a key support level: Suppose a trader is tracking the price of a stock that has been trading in a range for several weeks. The trader identifies a key support level at $100 and sets an entry point for a long position at $101, just above the support level. The trader also sets a stop-loss order at $99, just below the support level, to limit their losses if the trade goes against them.

Trading the breakout of a chart pattern: A trader might use a breakout strategy to trade a chart pattern such as a head and shoulders pattern. If the price breaks below the neckline of the pattern, the trader might enter a short position with a stop-loss order just above the neckline. They might exit the trade when the price reaches the target price based on the height of the pattern.

Position Trading Strategies

Position trading is a long-term trading strategy that involves holding positions for weeks, months, or even years. Position traders aim to profit from major market trends, and they typically use fundamental analysis to identify assets that are undervalued or overvalued.

Here are some common position trading strategies:

- Buy and Hold Strategy: This strategy involves buying a position and holding it for an extended period, typically for years. Position traders who use this strategy believe that markets tend to trend over the long term, and that holding a position for an extended period will allow them to capture a significant portion of the trend.

- Value Investing Strategy: This strategy involves identifying assets that are undervalued by the market and buying them in the expectation that they will rise in price over time. Value investors typically use fundamental analysis to identify undervalued assets, such as those with low price-to-earnings ratios or high dividend yields.

- Growth Investing Strategy: This strategy involves identifying assets that are growing rapidly and buying them in the expectation that they will continue to grow at a rapid pace. Growth investors typically use fundamental analysis to identify fast-growing companies with strong earnings growth, high profit margins, and a competitive advantage in their industry.

- Trend Following Strategy: This strategy involves identifying major market trends and taking positions in the direction of the trend. Position traders who use this strategy typically use technical analysis to identify market trends and enter positions when the trend is confirmed.

- Carry Trading Strategy: This strategy involves taking advantage of interest rate differentials between currencies. Position traders who use this strategy typically borrow money in a currency with a low interest rate and invest the borrowed funds in a currency with a high interest rate, earning a profit from the interest rate differential.

Day Trading Strategies

Day trading is a popular CFD trading style that involves opening and closing positions within the same trading day. The main goal of day trading is to make small, quick profits by taking advantage of the price movements that occur within a single trading session. Here are some common day trading strategies:

- Scalping: Scalping is a popular day trading strategy that involves making multiple trades within a single day to make small profits on each trade. Scalpers typically use technical analysis to identify short-term price patterns and make quick trades to capture small price movements.

- News Trading: News trading involves taking advantage of significant news events that can cause large price movements in the market. Day traders who use this strategy typically monitor news releases and economic data and look for opportunities to enter and exit trades quickly to capitalize on the price movements.

- Momentum Trading: Momentum trading is a strategy that involves buying assets that are trending upwards and selling assets that are trending downwards. Day traders who use this strategy typically use technical analysis to identify assets that are experiencing strong price movements and enter trades with the aim of capturing a portion of the price movement.

- Reversal Trading: Reversal trading is a strategy that involves identifying potential trend reversals and entering trades in the opposite direction to the current trend. Day traders who use this strategy typically use technical analysis to identify overbought or oversold assets and look for signs that the trend is about to reverse.

- High-Frequency Trading: High-frequency trading is a strategy that involves using computer algorithms to analyze large amounts of data and execute trades at high speeds. Day traders who use this strategy typically rely on technology to identify and execute trades quickly and capitalize on small price movements.

Why These Strategies Work in CFD Trading

Each of the trading strategies - day trading, position trading, breakout, mean reversion, and trend following - has a different approach to CFD trading. Here is a brief explanation of how each of these strategies works in CFD trading:

- Position Trading: Position traders hold their positions for longer periods, ranging from a few days to several months. They rely on fundamental analysis and economic data to identify opportunities and make trading decisions. Position trading requires patience and discipline, as traders must be willing to withstand short-term fluctuations in the market. CFDs can be useful for position trading as they allow traders to hold positions for extended periods without the need to own the underlying asset.

- Breakout Trading: Breakout traders look for significant price movements that break through support or resistance levels. They believe that when the price breaks through these levels, it will continue in the same direction. Breakout trading requires a strong understanding of technical analysis and the ability to identify key levels. CFDs can be useful for breakout trading as traders can take advantage of these significant price movements without the need to own the underlying asset.

- Mean Reversion Trading: Mean reversion traders believe that prices tend to revert to their long-term averages after significant moves in either direction. They use technical indicators and statistical analysis to identify when a price is overbought or oversold, and they enter positions with the expectation that the price will eventually revert to its mean. CFDs can be useful for mean reversion trading as traders can take advantage of short-term price fluctuations without the need to own the underlying asset.

- Trend Following Trading: Trend following traders look for long-term trends in the market and enter positions in the direction of the trend. They use technical indicators to identify the direction of the trend and the best entry and exit points. Trend following trading requires patience and discipline, as traders must be willing to hold positions for extended periods.

CFDs can be useful for trend following trading as traders can take advantage of long-term trends without the need to own the underlying asset.

Overall, CFDs can be a useful tool for implementing different trading strategies, as they offer traders the ability to take both long and short positions on various markets with leverage, allowing them to make profits from small price movements. However, it is essential to have a well-defined trading strategy and risk management plan in place to avoid significant losses.

Advantages and disadvantages of day trading, position trading, breakout, mean reversion and trend following strategies

| Trading Strategy | Advantages | Disadvantages |

|---|---|---|

| Day Trading | Potential for high returns in a short amount of time; ability to take advantage of intraday price movements and news events; opportunity to close out positions before the end of the trading day. | Requires a significant amount of time and attention to monitor positions; high risk due to the fast-paced nature of the strategy; requires significant experience and skill to be successful. |

| Position Trading | Less stressful than day trading; allows for more time to analyze and make decisions; lower transaction costs due to fewer trades. | Lower potential for high returns; positions may take longer to realize profits; may miss out on short-term market movements. |

| Breakout Trading | Can generate quick profits during high volatility periods; easy to implement with clear entry and exit points. | High risk due to potential for false breakouts; requires significant analysis to identify breakout points; may miss out on smaller market movements. |

| Mean Reversion Trading | Capitalizes on market reversals and can generate profits over longer timeframes; less reliant on short-term market volatility. | Requires significant analysis and skill to identify overbought and oversold market conditions; positions may take longer to realize profits; may miss out on market trends. |

| Trend Following Trading | Can generate significant profits during sustained market trends; can be applied to a wide range of markets and timeframes. | Requires significant analysis and skill to identify and follow trends; may result in losses during market reversals; may miss out on short-term market movements. |

Bottom Line For Trading Strategies and Techniques for CFDs

CFD trading can be an exciting and potentially profitable activity. However, it's important to understand the risks involved and take steps to manage them. As a trader, you can use different strategies and techniques like technical and fundamental analysis, risk management, and diversification to improve your chances of success. Remember to always do your own research, seek advice from professionals, and use reputable trading platforms. Trading can be a fun and rewarding experience if done correctly, so take the time to learn and develop your skills.