- Education

- About Forex

- How to Trade Forex With $100

How to Trade Forex With $100

Forex trading is an exciting and potentially profitable endeavor that has become increasingly accessible in recent years. With just $100, you can start trading Forex and potentially make profits.

However, it's important to understand the risks and challenges involved and to approach trading with a solid strategy and disciplined mindset. In this article, we'll provide some tips and guidelines for trading Forex with $100.

How to Trade Forex With $100

The first step to successful Forex trading is to understand the market itself. Forex, short for foreign exchange, is the market where traders buy and sell currencies. It's the largest financial market in the world, with a daily trading volume of over $5 trillion.

Trading takes place between banks, institutions, and individual traders through electronic networks. This means that Forex trading is open to anyone with an internet connection, and it's possible to trade at any time of day or night.

One of the key features of Forex trading is leverage, which allows traders to control large positions with a relatively small amount of capital.

For example, with a leverage of 1:100, you can control a position of $10,000 with just $100 in your account. While Forex leverage can amplify your profits, it can also magnify your losses, so it's important to use it wisely.

Choose a Forex Broker

To start trading Forex, you'll need to choose a Forex broker. A Forex broker is a company that provides access to the Forex market through its trading platform. There are many Forex brokers to choose from, and it's important to do your research to find a reputable and trustworthy broker.

Some of the factors to consider when choosing a Forex broker include:

- Regulation: Look for a broker that is regulated. Regulation helps to ensure that the broker operates with transparency and follows strict rules and guidelines.

- Trading platform: The trading platform is the software that you'll use to place trades and manage your account. Look for a platform that is easy to use, reliable, and offers a wide range of tools and features.

- Spreads and fees: Forex brokers make money by charging spreads and fees on trades. Look for a broker that offers competitive spreads and reasonable fees.

- Customer support: It's important to choose a broker that provides good customer support, in case you have any questions or issues with your account.

Develop a Trading Strategy

Before you start trading Forex, it's important to develop a trading strategy. A trading strategy is a set of rules and guidelines that you'll follow when placing trades. A good trading strategy should be based on sound analysis and should take into account your risk tolerance and trading goals. There are many different Forex trading strategies to choose from, but some of the most popular include:

- Trend trading

- Range trading

- Breakout trading

- Reversal trading

- Gap trading

- Pairs trading

- Arbitrage

- Momentum trading

Whatever trading strategy you choose, it's important to test it thoroughly and to stick to your plan when placing trades. Avoid making impulsive decisions based on emotions or market rumors.

Here's an example of a simple trading strategy that could work with $100.

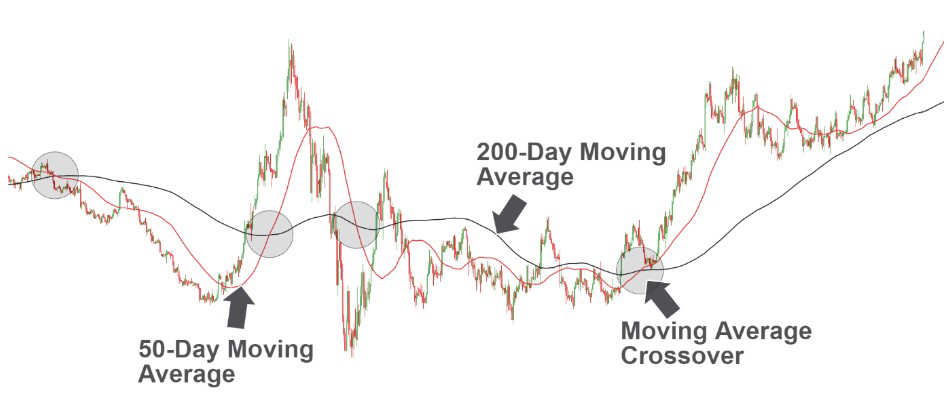

Strategy:Moving Average Crossover

The moving average crossover strategy is a popular and widely used trading strategy in Forex. The strategy involves using two moving averages: a fast moving average (such as the 50-Day Moving Average) and a slow moving average (such as the 200 - Day Moving Average). When the fast moving average crosses above the slow moving average, it's a buy signal, and when the fast moving average crosses below the slow moving average, it's a sell signal.

Step 1. Choose a Currency Pair

Let's say you choose the EUR/USD currency pair.

Step 2. Set up your Chart

Set up your chart with the 200-period and 50-period Day Moving Average. You can do this on most Forex trading platforms.

Step 3. Wait for a Signal

Watch the chart until the fast moving average (50-Day Moving Average) crosses above the slow moving average (200-Day Moving Average). This is a buy signal.

Step 4. Enter a Trade

Enter a long trade (buy) on the EUR/USD currency pair. Let's say you buy 0.01 lots (or 1,000 units) at the current market price of 1.2000. This would cost you $12 (assuming a leverage of 1:100).

Step 5. Set a Stop-Loss

Set a stop-loss order at 1.1950. This would limit your potential loss to 50 pips, or $5.

Step 6. Set a Take-Profit

Set a take-profit order at 1.2050. This would give you a potential profit of 50 pips, or $5.

Step 7. Monitor the Trade

Monitor the trade and wait for the price to reach your take-profit or stop-loss level. If the price reaches your take-profit level, your trade will automatically close, and you'll make a profit of $5. If the price reaches your stop-loss level, your trade will automatically close, and you'll lose $5.

Step 8. Repeat the Process

If the price didn't reach your take-profit or stop-loss level, you can wait for the next signal (when the fast moving average crosses below the slow moving average) and repeat the process.

Note: this is just an example, and there are many variations of the moving average crossover strategy. It's important to backtest your strategy and make sure it fits your trading style and risk tolerance before using it with real money. It's also important to remember that no trading strategy is 100% guaranteed, and there is always a risk of losing money in Forex trading.

You can download MetaTrader 4 and try this strategy, or any other for that matter, on Demo or Real account.

Manage Your Risk

One of the most important aspects of successful Forex trading is risk management. Forex trading is inherently risky, and there is no way to completely eliminate the risk of losing money. However, by managing your risk effectively, you can minimize your losses and protect your capital.

One of the key tools for managing risk in Forex trading is the stop-loss order. A stop-loss order is an order to close a trade at a predetermined price level. By setting a stop-loss order, you can limit your potential losses on a trade.

For example, let's say you buy the EUR/USD currency pair at 1.2000, and you set a stop-loss order at 1.1950. If the price of the EUR/USD drops to 1.1950, your trade will automatically close, and your potential loss will be limited to 50 pips.

It's also important to manage your leverage effectively. While leverage can amplify your profits, it can also magnify your losses. As a general rule, it's a good idea to use low leverage when you're starting out. A leverage of 1:10 or 1:20 is usually sufficient for most traders.

Another important aspect of risk management is diversification. Rather than putting all your capital into a single trade, it's a good idea to spread your capital across multiple trades and currency pairs. This can help to reduce your overall risk and increase your chances of success.

Stay Disciplined and Patient

You may think that this is something small but it is important to stay disciplined and patient when trading Forex. Forex trading can be exciting and fast-paced, but it's important to avoid making impulsive decisions based on emotions or market rumors.

Stick to your trading strategy, and avoid deviating from your plan. Don't chase profits or try to make up for losses with bigger trades. Instead, focus on consistency and discipline.

It's also important to be patient. Forex trading is a marathon, not a sprint. Don't expect to make huge profits overnight. Instead, focus on making small, consistent profits over time.

The Bottom Line For How to Trade Forex With $100

In summary, Forex trading with $100 is possible, but it requires careful planning, discipline, and risk management. Start by understanding the Forex market, choosing a reputable broker, and developing a solid trading strategy.

Manage your risk effectively with stop-loss orders, low leverage, and diversification. Finally, stay disciplined and patient, and focus on making small, consistent profits over time. With the right approach, Forex trading can be a rewarding and potentially profitable endeavor.